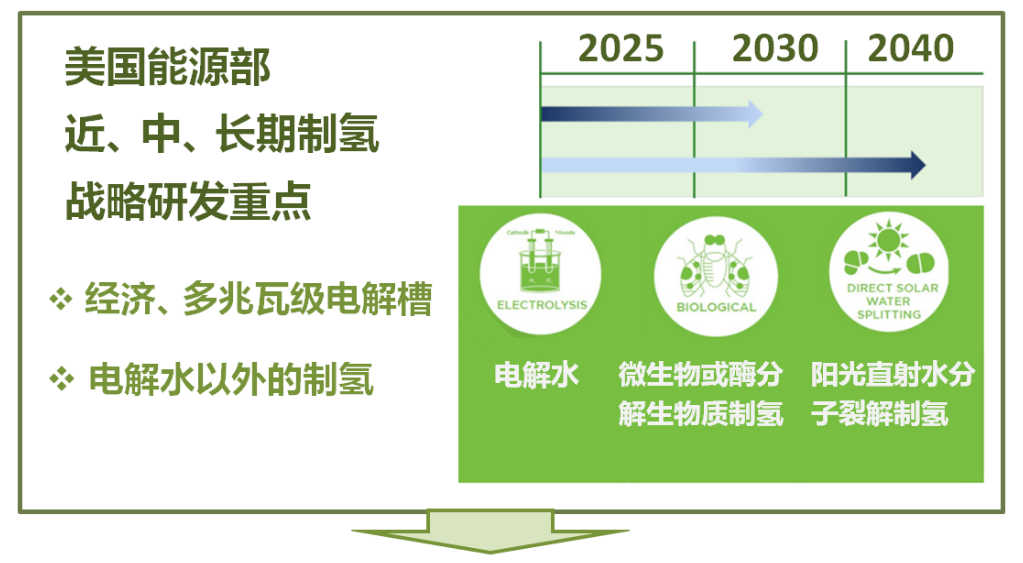

The author predicts: in the next five years, PEM electrolytic water will be from the minority to the mainstream, to achieve a leap from MW to GW level, SOEC is expected to usher in a substantial stage of development, and AEM has gradually begun to enter the early market. In addition, it may usher in the emergence of disruptive technologies, such as biological, sunlight water molecular cracking technology.

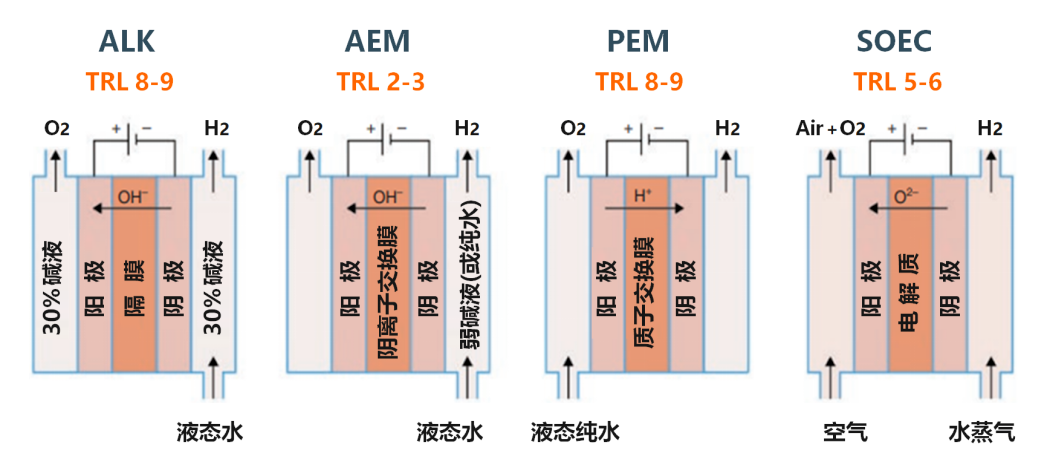

This paper reviews the four major electrolytic water technologies of alkaline (ALK), proton exchange membrane (PEM), anion exchange membrane (AEM) and solid oxide (SOEC), as well as the development trends in Europe and America.

Introduction

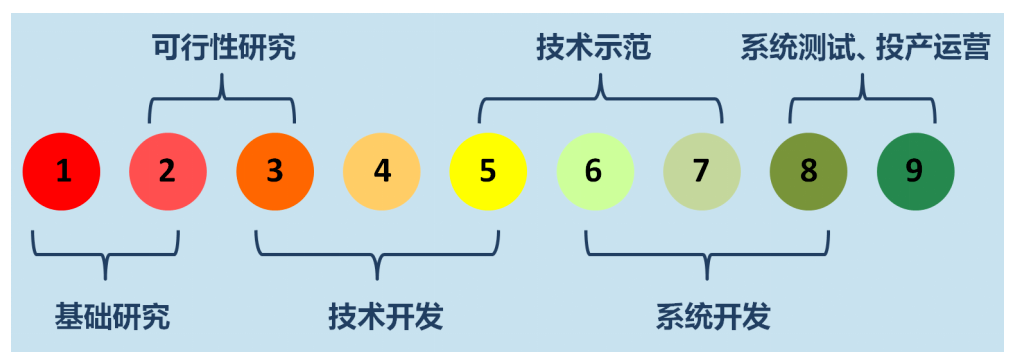

The Technology Maturity (TRL) shown above is the U.S. Department of Energy's 2020 classification. The EU's 2020 assessment of its SOEC is TRL7, higher than the US Department of Energy's TRL5-6.

In terms of material, performance, efficiency and cost, each of the four water electrolysis technologies shown above has its own advantages and challenges. Compared with alkaline electrolyzers, the advantages of PEM in specific application scenarios (such as car-gauge hydrogen energy, fluctuating renewable energy) are increasingly obvious, and many new projects in the world have begun to use PEM electrolyzers, and its market penetration is expected to gradually expand. SOEC and AEM, as emerging technologies, have great potential and are also the focus of research and development in Europe and the United States, but the former needs to be improved in durability and manufacturing process before large-scale production, and the latter is still in the stage of basic material research and development.

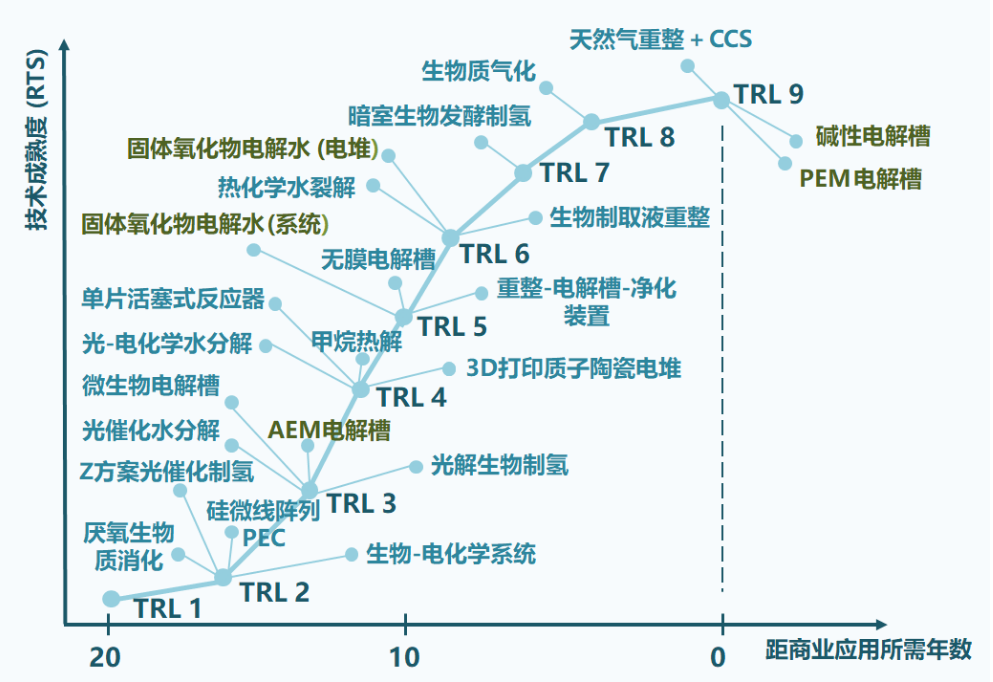

Both the United States and the European Union have adopted PEM and SOEC water electrolysis as a near-term research and development focus, and Biomass hydrogen production as a medium-term goal. In addition, the US Department of Energy will directly use the sun's light and heat (photoelectric catalysis) to produce hydrogen as a long-term research and development strategy, and its three categories of hydrogen production routes are reflected in the maturity of the relevant technologies in Figure 2.

Proton exchange membrane (PEM) electrolyzers

Proton exchange membrane (PEM) electrolyzers use a thin perfluorosulfonic acid membrane (PFSA) and advanced electrode structure for low resistance and high efficiency. The PFSA membrane is chemically and mechanically stable and can withstand pressure, so the PEM cell can operate at up to 70 bar, while the oxygen side is at normal pressure. The disadvantage of PEM electrolyzer is that it needs to work in a highly acidic, high potential and unfavorable oxidation environment, so it needs a highly stable material. Expensive titanium-based materials, precious metal catalysts and protective coatings are necessary, which not only provide high stability for the battery elements, but also provide good conductivity and cell efficiency. PEM systems have a compact, simple design, but are sensitive to water impurities (e.g., iron, copper, chromium, sodium) and can be affected by calcination.

The table above shows the major suppliers of PEM electrolytic water systems in Europe and the United States, which have had large financing, mergers and acquisitions and integration in recent years. For example, ITM in the UK, following a £58.8 million funding round in 2019 (including Linde's $38 million), completed a £172 million funding round in 2020 (including Italy's Snam's $30 million), and plans to build a plant with an annual capacity of 1.5GW in 2023 and 2.5GW in 2024.

In continental Europe, in October 2020, France's Gaztransport & Technigaz (GTT Group) acquired AREVAH H2Gen for approximately €8 million and renamed it Elogen.

In the U.S., Plug Power acquired Giner ELX for $58 million in 2020 and Frames Group for $98 million last year, giving it access to the former's PEM electrolysis water lab technology and the latter's equipment and engineering capabilities. In addition, Plug acquired United Hydrogen, a civilian liquid hydrogen production, storage and transportation company, for $65 million in 2020. Following fuel cell forklifts, Plug plans to develop PEM water electrolysis into another of its main businesses. In 2007, Plug acquired forklift focused General Hydrogen (founded by Geoffrey Ballard after he left Ballard in 2000) for $10 million, setting the stage for fuel cells to break the ice in forklifts. Plug has deployed more than 40,000 forklifts across the United States.

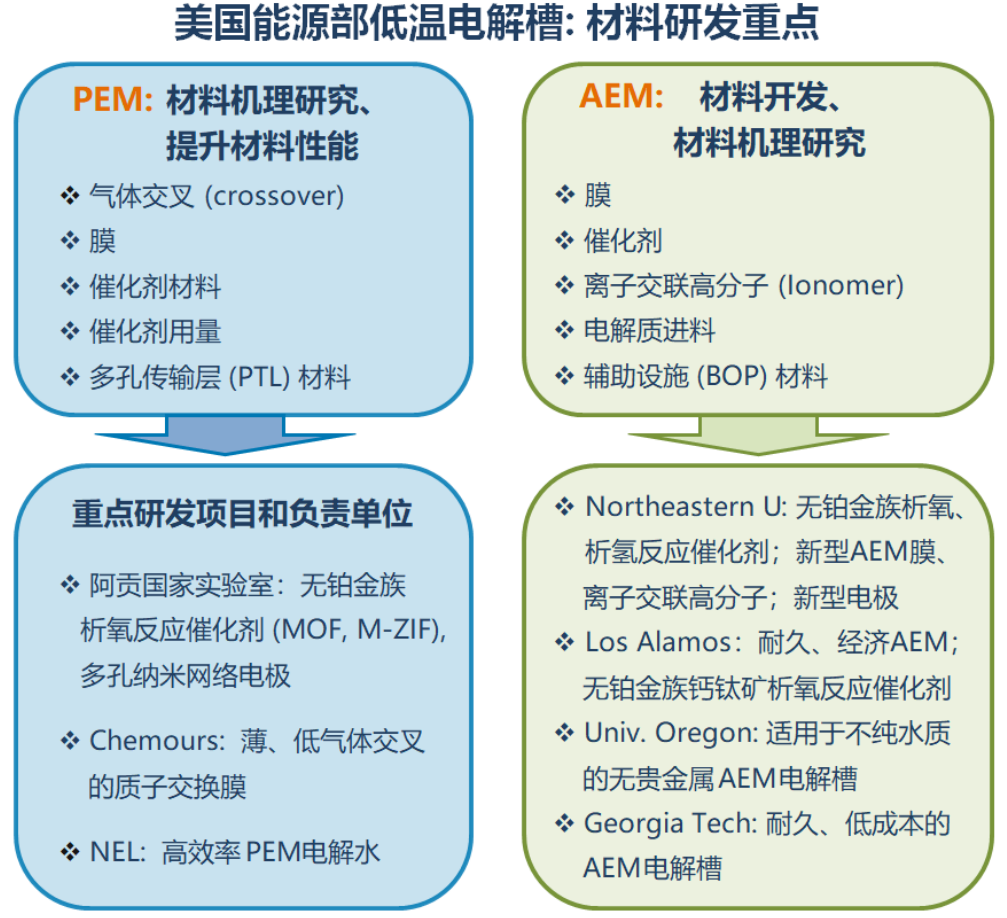

As a representative of electrolytic water technology in the United States, Giner ELX and its former parent company, Giner Labs, have received funding from the U.S. Department of Energy for several PEM and AEM R&D projects. At present, the research and development of PEM electrolytic water materials in the United States focuses on mechanism research and improving material properties, while AEM is material development and mechanism research, and a research and development project led by universities and national laboratories has been established in the figure below.

Anion exchange membrane (AEM) electrolyzer

As the latest water electrolysis technology, anion exchange membrane (AEM) electrolyzers have the potential to combine the low cost of alkaline electrolyzers with the simplicity and efficiency of PEM. This technology can use non-precious metal catalysts, no titanium components, and can operate at differential pressure like PEM, but currently AEM films have chemical and mechanical stability issues that affect the life curve. In addition, the low conductivity of AEM film, slow catalytic kinetics and poor electrode structure also affect the performance of AEM. The performance improvement is usually achieved by adjusting the conductivity of the membrane, or by adding a supporting electrolyte (such as KOH, NaHCO3), but this in turn reduces the durability. In PEM, the conduction rate of OH- ions is three times slower than that of H+ protons, so AEM will face greater challenges to develop thinner or higher charge density films, and also put higher requirements on BOP auxiliary systems.

According to the need for alkaline electrolyte, the current international AEM research and development direction is divided into alkaline electrolyte system and pure water system (that is, no lye, easy to maintain the system). The former focuses on improving current density and durability; The latter is to improve membrane stability and use advanced membranes and no (or low) PGM catalysts to improve performance and durability. In addition, the unit stack cost of AEM is much lower than that of PEM, so it is also a research and development strategy to improve the power efficiency of AEM by reducing the cell voltage.

At present, AEM technology is still in the research and development stage. The leading international developer and manufacturer is Italy's ENAPTER, which has commercialized small products. The top right of the figure below is the public parameters of its products, and the bottom right is the information of the U.S. Department of Energy's 2021 questionnaire survey.

At present, ENAPTER's research and development focus on improving the conductivity and durability of the membrane in pure water systems, with a current density of >1A/cm2 (chamber operating voltage 1.8V) and a decay rate of <15mV/1000 hours. In terms of membrane research and development, Ionomr Innovations Inc. Some progress has been made and its Aemion+™ membrane is addressing the root cause of the unstable decomposition mechanism in the AEM polymer structure.

Solid oxide (SOEC) electrolyzers

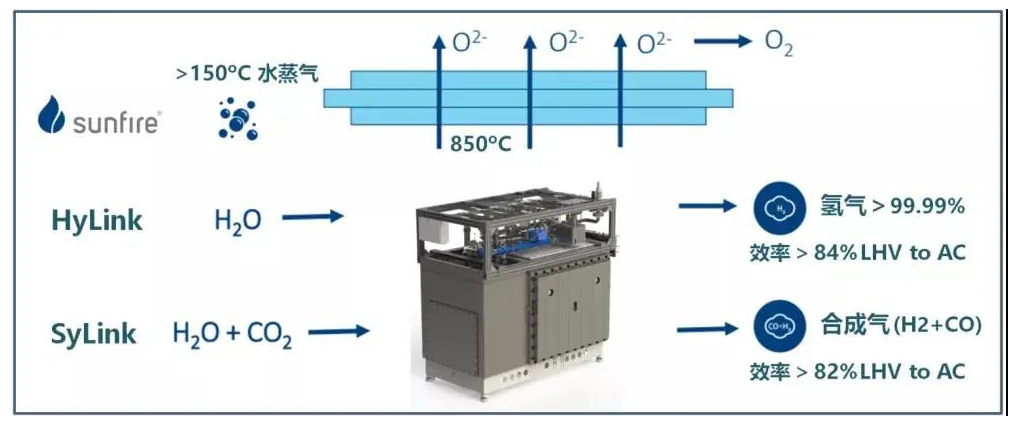

Solid oxide (SOEC) electrolyzers operate at high temperatures (700-850 ° C), and the advantages of kinetics allow the use of inexpensive nickel electrodes. Using high-quality waste heat from industrial production (such as energy input of 75% electricity +25% heat from water vapor), SOEC's system efficiency (LHV H2 to AC) is expected to reach 85% in the near future, and within 10 years to meet the EU 2030 target of 90%. The SOEC cell is fed with water vapor, and when carbon dioxide is added, Syngas (a mixture of hydrogen and carbon monoxide) is produced, which is then further produced into synthetic fuels (e-fuels, such as diesel and jet fuel). Therefore, SOEC technology is expected to be widely used in carbon dioxide recovery, fuel production and chemical compounds, which is the EU's research and development focus in recent years. Another advantage of SOEC is reversibility, the use of reversible fuel cells for the storage of renewable energy, which is also a long-term focus of research and development in Europe and the United States.

Durability is currently a top priority for SOEC, and the thermochemical cycle, especially when the system is stopped and started, will accelerate aging and reduce service life. Current materials for solid oxides include zirconium dioxide, which is stabilized by adding 8% yttrium oxide and has the molecular formula (ZrO2)0.92(Y2O3)0.08. Improving the performance, durability and reducing the operating temperature of solid oxides are currently the focus of research and development in Europe and the United States.

U.S. SOEC representatives include FuelCell Energy and Cummins. Between 2016 and 2020, FuelCell Energy was responsible for a US $3 million DOE grant for SOEC research and development and achieved the following targets.

- Reactor efficiency (LHV H2 to AC) >95%

- System efficiency (LHV H2 to AC) >90%

- System efficiency (LHV, measured in electricity + heat) >75%

- Single battery attenuation rate ≤1%/1000 hours; Stack decay rate ≤2%/1000 hours

- Develop subsystems to make SOEC compatible with intermittent renewable energy sources.

In September 2021, Cummins received a $5 million grant from the U.S. Department of Energy for research and development of automated assembly and production of SOEC stacks. The project will leverage Cummins' existing proven thermal spray process to automate the production of metal-based solid oxide stacks, reducing the expensive sintering process and reducing the number of seals required by 50 percent. The three-year project, with a total budget of $7.16 million, aims to develop a standard template for automated assembly of a 60kW solid oxide reactor for the establishment of a SOEC electrolytic cell plant with an annual capacity of 94MW.

In January 2020, the EU launched the SOEC Demonstration project with a total budget of 9.75 million euros (of which FCH JU contributed 7 million), aiming to raise the technical maturity of SOEC from TRL7 to TRL8 within five years, and developed the following KPIs.

- System power consumption (standard working condition) ≤ 39kW/kgH2

- Stack decay rate ≤ 1.2%/1000 hours

- Operating time ≥ 98%

- Unit investment cost (1 kg per day hydrogen production capacity) ≤ 2,400 euros

- Annual operation and maintenance cost (1kg of hydrogen per day) ≤ 120 euros

Germany Sunfire is the European SOEC technical representative. The Saxony-based company was founded in 2010 and acquired a SOFC company the following year as the technical core of its later development. Based on a Power-to-Liquid (PtL) process, Sunfire completed a project demonstration of 2.4MW SOEC in the Netherlands in October 2020, producing 60 kg of hydrogen per hour for the production of synthetic fuels, with a system energy efficiency (LHV H2 to AC) target of 85%.

Sunfire is an active participant in the German H2Giga program. Earlier this month, the company and 15 partners under its leadership received a €33 million grant from the German Federal Ministry of Education and Research (BMBF) for SOEC cell system optimization, manufacturing processes and volume production.

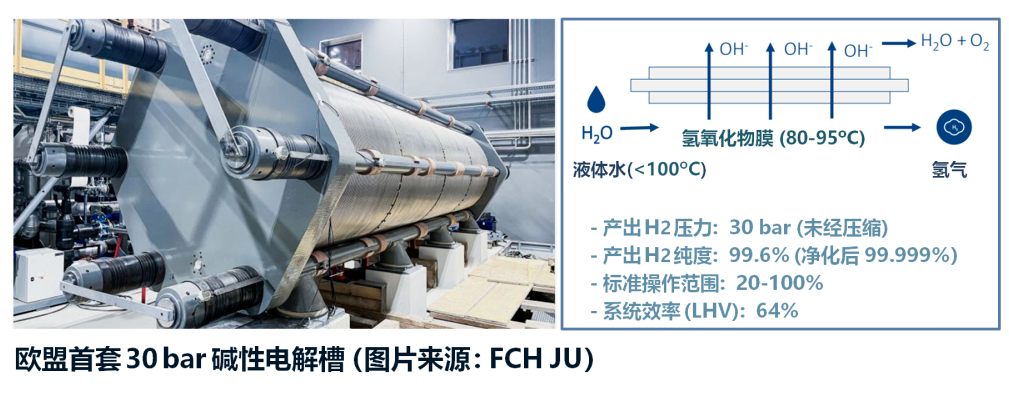

Sunfire raised €109 million in Series D funding in November 2021 (it had previously raised more than €100 million) and plans to build 200MW of SOEC electrolyzer capacity by 2023. In terms of mergers and acquisitions, Sunfire acquired Swiss electrolyzer company IHT in January 2021 and in November installed the EU's first 3.2MW alkaline electrolyzer with a working pressure of 30 bar at a food production centre in Austria. The cell is a core part of the EU Demo4Grid demonstration project to demonstrate the commercial viability of pressurized alkaline electrolyzers to balance the grid in real market conditions and produce green hydrogen for industrial use. The five-year project has a total budget of €7.8 million, of which €2.9 million is funded by FCH JU.

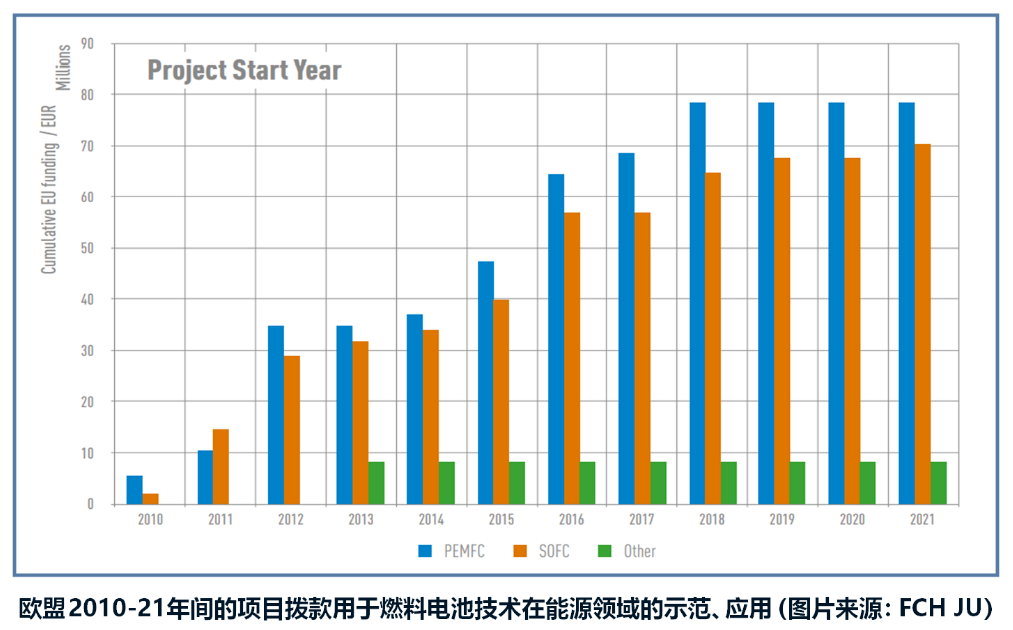

The following chart shows the European Union's allocation for the 2010-2021 period for fuel cell technology applications in the energy sector, demonstration projects (such as cogeneration, balanced grid, off-grid generation), The annual project funding for PEMFC, SOFC and other technologies since 2018 is approximately 78 million, 70 million and 8 million euros respectively (blue, Orange and green). Major participating companies and research institutions include: SolidPower, Sunfire, Ballard, Politecnico di Torino (Polytechnic University of Turin) and VTT Technical Research Centre of Finland.

American hydrogen research and development system

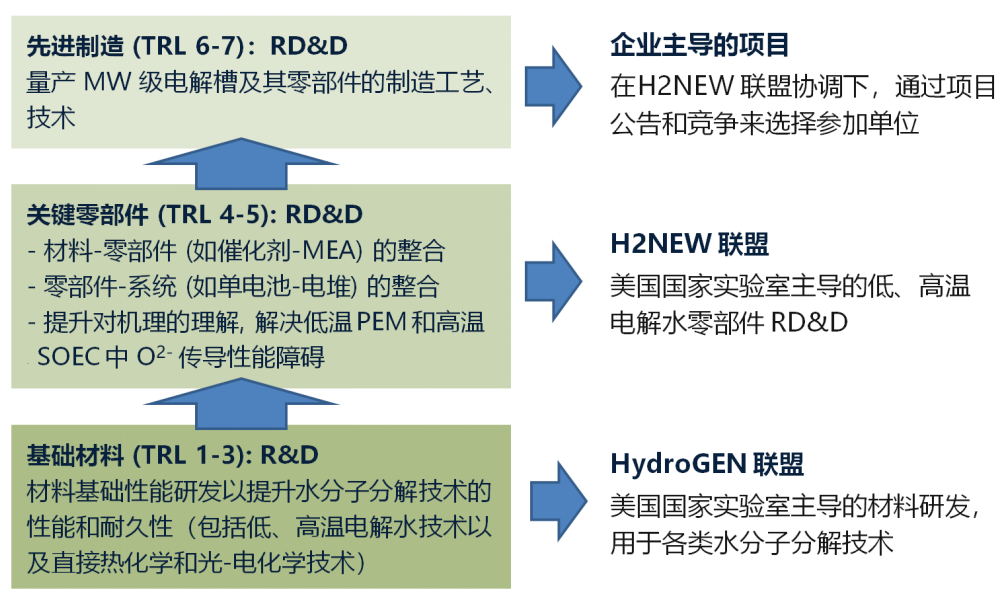

A stone from another mountain can attack jade. This section takes electrolytic water research and development as an example to introduce the United States research and development system divided by technology maturity and dominated by national laboratories. RD&D = Research, Development & Demonstration.

The Technology Readiness Level (RTL) assessment method has been used for a long time by the space and defense departments in the United States. It is divided into nine levels in the form of a system, as shown in the figure above, to determine the material, process status and production readiness of the product for research and development, and allocate the corresponding resources. The tool proved to be very effective and feasible, not only to assess the needs of different stages of development, but also to provide the necessary guidance for the final product.

The United States Department of Energy (DOE) is the United States federal government responsible for energy policy development, industry management and related technology research and development and other responsibilities of the executive department, its 17 national laboratories are currently engaged in hydrogen energy related research and development. DOE will be divided into three types of electrolytic water research and development topics according to technology maturity, and set up the corresponding alliance (Consortium), so as to form a three-level progressive from basic materials, key parts to production and manufacturing, to avoid the weak situation of key parts in the demonstration and promotion stage. In addition, DOE funding is not limited to domestic units in the United States, for example, Ballard in Canada has received tens of millions of dollars in DOE research and development funds in various forms of contracts.

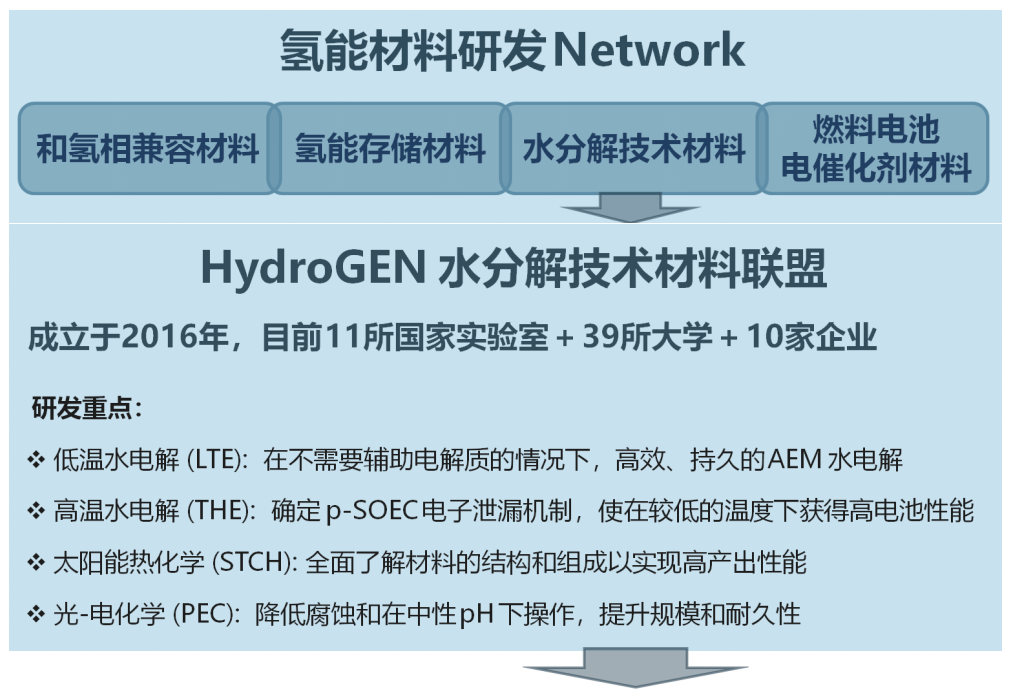

Basic materials are the cornerstone of high-end manufacturing. In the case of hydrogen energy, the U.S. Department of Energy has formed the Hydrogen Energy Materials Research and Development Network, which consists of the following four material alliances, to accelerate the breakthrough of early-stage applied materials in the field of hydrogen energy.

Review and prospect

Since electrolytic water was invented in the United Kingdom in 1800, the development of electrolytic cells has experienced more than two centuries, and technological advances in different periods (especially breakthroughs in materials) have greatly affected its development process. Before 1950, electrolytic water was mainly used to produce synthetic ammonia from low-cost hydropower, and alkaline electrolyzers were the only technology available during this period. In the 1940s, DuPont invented a material with both mechanical, thermal stability and good proton transport performance, making PEM technology possible, and was first applied to aviation, military fields, and entered the commercial field in the 1980s. After 2010, with the promotion of photovoltaic, wind power and the falling cost of electrolyzers, green hydrogen became a commercially viable case and entered the energy policy agenda of countries with the global consensus on climate action.

In the next five years, the author expects PEM electrolytic water will be from the minority to the mainstream, achieving a leap from MW to GW level. With the continuous breakthrough of material technology, SOEC is expected to usher in a substantial development stage, and AEM has gradually begun to enter the early market. In addition, the investment of countries in the research and development of new hydrogen production will continue to increase, which may usher in the emergence of disruptive technologies, such as biological, sunlight water molecular cracking technology.

Looking back at history, the development of space technology has also greatly advanced the research and development frontier of fuel cells. In the 1990s, NASA developed a Unitized Regenerative Fuel Cell System for its deep space program, In the early 2000s, a reversible fuel cell based on PEM technology was developed by Proton OnSite. Bloom Energy's commercialized ES-5000 energy server is also based on its solid oxide technology developed for NASA's Mars program.

Endure hardships to enlighten the mountains. The internationally renowned Dalian Institute of Chemical Physics is the birthplace of China's fuel cell technology, and its initial research originated from the development of space hydrogen oxygen fuel cells in 1967. Today, half a century later, following the successful completion of the 2021 Mars exploration mission, NASA plans to conduct the first manned Mars exploration in 2033, exploring the establishment of a permanent settlement on the Red Planet, so that humans can keep watch on Earth and Mars in the vast universe.

微信扫码 关注我们

微信扫码 关注我们

24小时咨询热线

移动电话13419663615

Copyright © 2022 All Rights Reserved. 地址:Rm 058,209,2F,Podium Bldg,C2 Bldg,Longshan Imno.Park,FutureSci.&Tech.City, No.999 GaoxinAve, Wuhan 430206 苏ICP123456 XML地图